Vouchers in Accounting

Source Document or Vouchers are the written evidence of Business transactions, such as Cash memo, Invoice, Sales bill, Pay-in-slip, Cheque, Salary slip, etc.

When there is no documentary for any items, voucher may be prepared showing the necessary details and got approved by appropriate authority within the firm.

All such documents (vouchers) are arranged in chronological order, serially numbered and kept in a separate file.

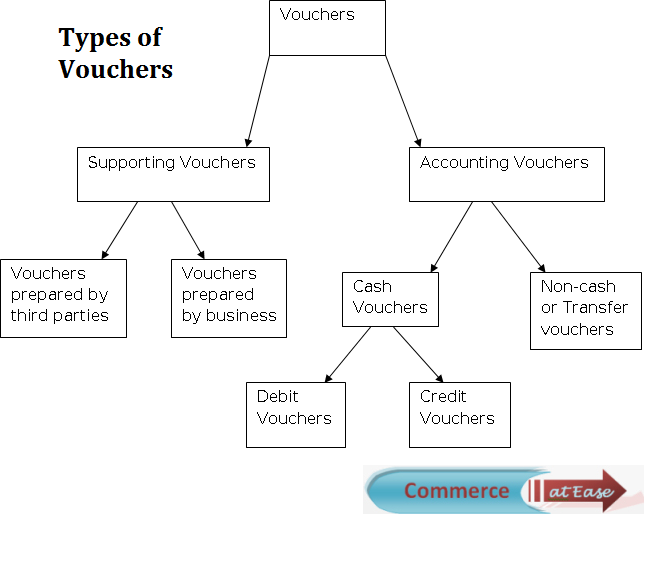

Accounting vouchers are prepared to make entries for recording, on the basis of these supporting vouchers.

Accounting vouchers are classified as cash vouchers, debit vouchers, credit vouchers, journal vouchers, etc.

Cash Voucher is used for recording cash transactions; cash receipts or cash payments.

Debit Voucher is used for recording cash payments.

Credit Voucher is used for recording cash receipts.

Transfer Voucher is used to record non-cash transactions like credit purchases, depreciation etc.

Transaction Voucher is the accounting voucher prepared for a transaction with one debit and one credit.

Compound Voucher records a transaction that involves multiple debits/credits and one credit/debit. Compound voucher may be: (a) Debit Voucher or (b) Credit Voucher.

Complex Voucher/ Journal Voucher is used to record transactions with multiple debits and multiple credits, called complex transactions.